Comparative Advantage, Absolute Advantage, and Terms of Trade

Updated 6/17/2024 Jacob Reed

A fundamental goal of economics is the efficient use of resources. Using the concept of comparative advantage to guide the use of resources can help with that end. The Advanced Placement Economics Exam usually has a few questions about comparative advantage in the multiple choice section and it appears on both the microeconomics and macroeconomics exams so it is an important topic for students to review. Below you will find a run-down of absolute advantage, comparative advantage and terms of trade. When you are done, head to the comparative advantage review game to practice and make sure you get it.

Absolute Advantage

Absolute Advantage is the ability of one entity to produce more of a good or service with fixed resources, or the same amount with fewer resources than another entity. For example, if Katrina can type 6 pages in an hour, and Davis can type 8 pages in an hour, Davis has an absolute advantage in typing because he can produce more typed pages with an hour of labor than Katrina can. But if Katrina can mow a lawn in 15 minutes while it takes Davis 20 minutes to mow that same lawn, then Katrina has an absolute advantage in mowing lawns. That is because Katrina can mow a lawn using fewer resources (minutes of labor). Essentially the absolute advantage goes to the person or entity that is better at producing the good in question. Absolute advantage is a term you need to understand and remember, but it isn’t very helpful in determining how resources should be used. In order to determine how resources should be used comparative advantage is needed.

Comparative Advantage

Comparative Advantage is the ability of one entity to produce a good or service at a lower opportunity cost than another entity. When it comes to calculating opportunity cost there are 2 methods; depending on whether you are looking at outputs (with fixed inputs) or inputs (with fixed outputs).

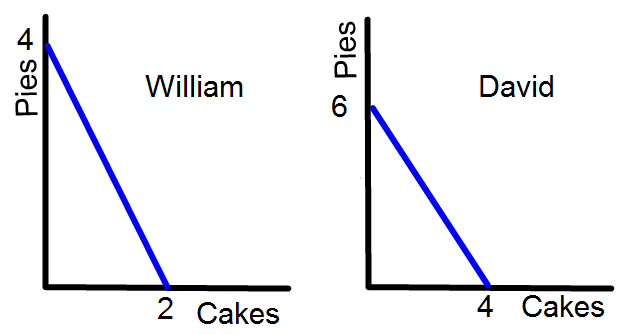

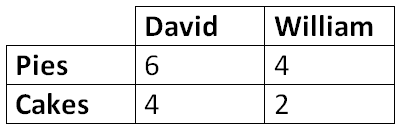

Outputs: Take a look at the two production possibilities curves. In this example David and William both like to bake. When looking at their respective PPC’s only the maximum levels of production are relevant (where the PPC hits both axes). William can cook 2 cakes or 4 pies in an afternoon. David can cook 4 cakes and 6 pies. With output questions the numbers provided are the quantities of finished products. Since the amount of time is fixed, this is an output question.

While David has the absolute advantage for both goods (he is able to produce more of both outputs), that fact isn’t relevant when determining comparative advantage. Determining comparative advantage requires calculating opportunity costs. When calculating opportunity costs with Outputs, use the “Other Over” formula (output and other both start with “O”). The “Other Over” formula is:

Opportunity Cost of 1 A = B/A of B

So the opportunity cost of Cakes is Pies (the other one) divided by Cakes. Using the numbers from the PPC’s above, the opportunity costs are found below:

William’s Opportunity Costs

Opportunity cost of 1 pie = 2/4 cakes = 1/2 cakes

Opportunity cost of 1 cake = 4/2 pies = 2 pies

David’s Opportunity Costs

Opportunity cost of 1 pie = 4/6 cakes = 2/3 cakes

Opportunity cost of 1 cake = 6/4 pies = 1 1/2 pies

Based on the calculations above, William can produce a pie with an opportunity cost of 1/2 a cake. David has an opportunity cost of 2/3 a cake every time he makes a pie. William has the lower opportunity cost when producing pies, therefore he has the comparative advantage for pies. For cakes, William has an opportunity cost of 2 pies and David has an opportunity cost of 1 1/2 a pies. Since David gives up fewer pies every time he makes a cake, he has the comparative advantage for cakes. As a result, David should specialize in the production of cakes while William should specialize in the production of pies.

Note: the numbers found in the PPC’s above could also be displayed in a chart as well. The method for displaying the numbers doesn’t change anything. The key to deciding if you should use the Other Over formula is determining if the numbers are outputs. Since cakes and pies are what come out of the production, these are outputs.

Outputs Chart:

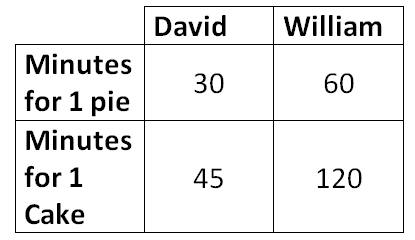

Inputs: You could also see compartative advantage questions where the numbers are inputs. instead of outputs. Take a look a the table to the right. Instead of how many cakes and pies they could each make in an afternoon (pies and cakes are outputs), the numbers are minutes it takes each of them to produce 1 cake or 1 pie. Since minutes of labor are an input into the production of each product, a different formula is required.

Based on these numbers, one can see David still has the absolute advantage for each good because he can produce pies and cakes with fewer inputs (fewer is better with inputs). To calculate opportunity costs for comparative advantage when Inputs are given, use the “It Over” formula (input and it both start with “I”). The “It Over” formula is:

Inputs Chart:

Opportunity Cost of 1 A = A/B of B

So the opportunity cost of Cakes is Cakes (it) divided by pies. Using the numbers from the PPC’s above the opportunity costs are found below:

William

Opportunity cost of 1 pie = 60/120 cakes = 1/2 cakes

Opportunity cost of 1 cake = 120/60 pies = 2 pies

David

Opportunity cost of 1 pie = 30/45 cakes = 2/3 cakes

Opportunity cost of 1 cake = 45/30 pies = 1 1/2 pies

Based on the opportunity costs above William can produce pies at a lower opportunity cost (1/2 cakes <2/3 cakes) so he has a comparative advantage for pies. David, on the other hand, can produce cakes at a lower opportunity cost (1 1/2 pies<2 pies) so David has the comparative advantage for cakes.

Terms of Trade: If William and David specialize in the the production of goods for which they have a comparative advantage, then trade, they could be able to exceed their own production possibilities (consume outside their own PPC curves).

Terms of trade is the rate at which one good could be traded for another. Terms of trade that benefit both entities will fall between each entities’ opportunity costs. In the example above William could produce 1 pie with an opportunity cost of 1/2 a cake and David can produce 1 pie with an opportunity cost of 2/3 of a cake. If William and David specialize and trade, they will agree to trade 1 pie for between 1/2 and 2/3 of a cake. Likewise, they will trade a cake for between 1 1/2 pies and 2 pies.

If the terms of trade fall outside the relative opportunity costs, one entity will benefit while the other will not. If 1 cake traded for 3 pies, the high number of pies (per cake) would benefit the person with the comparative advantage in making cakes (David) and hurt the person with the comparative advantage in making pies (William). If 1 cake trades for 1/2 of a pie the low number of pies (per cake) would hurt the person with the comparative advantage in making cakes (David)and benefit the person with the comparative advantage in making pies (William)

Multiple Choice Connections:

2012 Released AP Microeconomics Exam Questions: 16, 31

Up Next:

Review Game: Comparative Advantage and Terms of Trade Flash Activity

Content Review Page: Determinants of Demand

Other recommended resource: Marginal Revolution University Video