3 Things to Know About Per-unit Taxes

Updated 3/22/2024 Jacob Reed

1. How do taxes impact supply and demand?

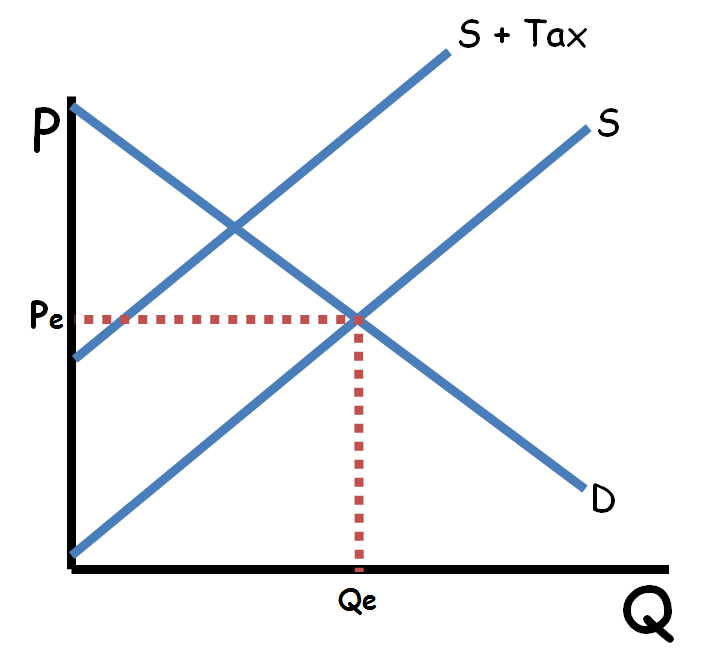

Excise taxes (per-unit taxes on the sale of a good) are one of the six determinants of supply. They shift the supply curve to the left decreasing supply and increasing the equilibrium price. The supply curve will shift until the vertical distance between the two curves is equal to the amount of the tax.

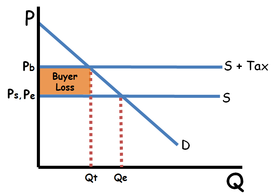

When a tax is imposed on a product, the burden of that tax is generally (see exceptions below) shared between the buyers and sellers. The total tax burden is found by drawing a vertical line from the new equilibrium down to the original supply curve. From these two points (where the line hits the two supply curves), draw horizontal lines to the price axis. This box is the tax revenue collected from the tax. If you draw a horizontal line from the original equilibrium price to the price axis, the tax revenue box will be divided. The upper portion will be the buyer’s tax burden and the lower portion will be the seller’s tax burden.

The price buyers pay is at the top of the tax revenue box (Pb), the price sellers receive after paying the tax is at the bottom of the tax revenue box (Ps). The portion of the per unit tax buyers and sellers pay is determined by comparing these prices to the original equilibrium price. So buyers pay Pb-Pe of the tax and sellers pay Pe-Ps of the tax (from the diagram to the right).

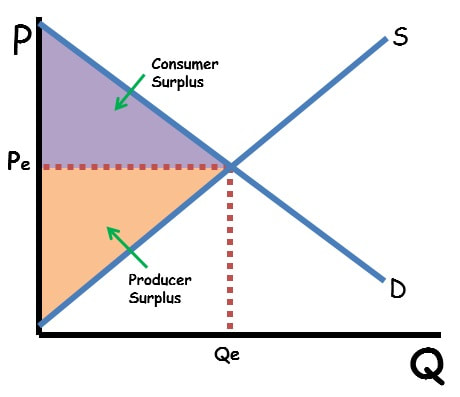

2. How do excise taxes impact economic surplus and deadweight loss?

If there are no externalities, excise taxes reduce consumer surplus and producer surplus and create deadweight loss. Below you will see consumer surplus and producer surplus before and after a per-unit tax as well as where deadweight loss is found after the tax.

3. How does price elasticity impact tax burdens?

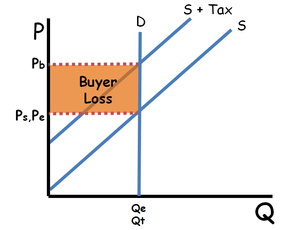

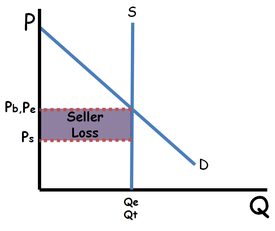

Price elasticity measures how sensitive buyers or sellers are to a price change. As a result, price elasticity impacts where tax burdens fall. The more inelastic curve pays more of the tax. That means the less price sensitive group (buyers or sellers) bear more of the tax burden.

When demand is more inelastic than supply, the tax burden will fall more on consumers than producers.

If demand is perfectly inelastic, the entire tax burden will fall on consumers.

If demand is perfectly elastic, the entire tax burden will fall on producers.

When supply is more inelastic than demand, the tax burden will fall more producers than consumers.

If supply is perfectly inelastic, the entire tax burden will fall on producers.

If supply is perfectly elastic, the entire tax burden will fall on consumers.

Multiple Choice Connections:

2012 Released AP Microeconomics Exam Questions: 18, 19

Up Next:

Review Game: Microeconomics Graph Shading

Content Review Page: Trade and Tariff Graph

Outside recommended video: No Bull Economics