How do Interest Rates Impact Exchange Rates and The Balance of Payments?

3/27/2024 Jacob Reed

In this article we will explore the relationship between interest rates and foreign exchange rates. This is our final topic in the AP Macroeconomics Course Exam Description (CED). Once you understand this topic, you will be ready to move on to your exam review.

Interest Rates and Foreign Investment

In previous units, the term “investment” has primarily meant purchases of physical capital (as in gross investment). There is an inverse relationship between interest rates and the quantity of domestic gross investment because businesses buying these investments must PAY interest rates in to order to borrow money to purchase the physical capital investments.

In this unit, we are looking at foreign investment. Foreign investors are not purchasing physical capital, they are purchasing bonds or saving in US banks. Foreign investors are PAID the interest rate. Essentially foreign investors are saving in the loanable funds markets, earning the real interest rate. So, when interest rates are high, financial capital (savings) flows into domestic financial markets as foreign investors seek these high interest rates. When interest rates are low, financial capital (savings) flows out of domestic financial markets as foreign investors seek higher interest rates elsewhere.

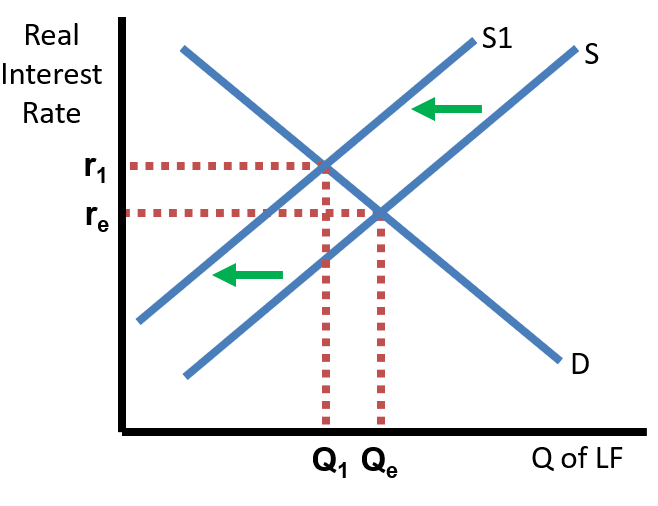

Note: These financial capital flows cause shifts of the supply curve within the loanable funds markets. Countries with high interest rates see a financial capital inflow, shifting the supply of loanable funds to the right (causing the interest rate to fall). Countries with lower interest rates see a financial capital outflow, shifting the supply of loanable funds to the left (causing the interest rate to rise).

Capital Flows and the Impact on Foreign Exchange

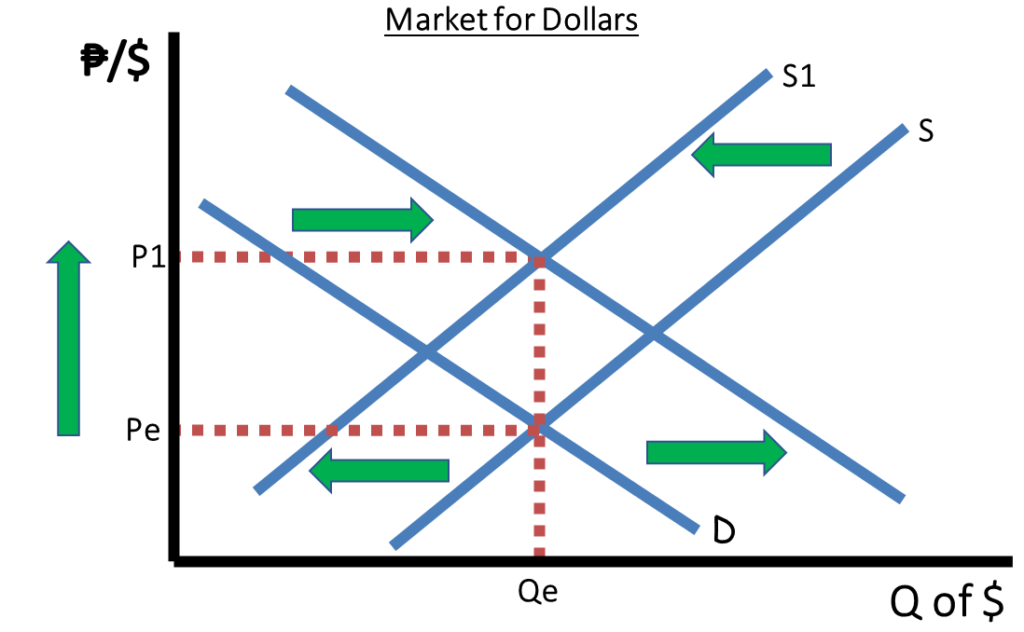

Suppose interest rates in the United States rise, foreign investors will seek those high interest rates. Since foreign investors need US dollars in order to buy US bonds or save in US banks, foreign investors must buy US dollars in the foreign exchange markets. That increases the demand for US dollars in the foreign exchange markets. At the same time, investors that already have dollars will be less likely to sell them because US dollars can earn high interest. That means the supply of US dollars will decrease in the foreign exchange markets. This double shift of an increase in demand and decrease in supply means the US dollar will appreciate (though the equilibrium quantity of dollars exchange will be indeterminate).

If interest rates in the United State fall, foreign investors will flee the low interest rates and seek higher returns in other countries. Foreign investors will sell us dollars as they buy other currencies. This means the supply of US dollars will increase. At the same time, since US financial assets have low earning potential, foreign investors will demand fewer dollars. In the end, the falling interest rates have caused a double shift of an increase in supply and decrease in demand means the US dollar will depreciate (again the equilibrium quantity is indeterminate).

Impact on the Balance of Payments

In the Balance of Payments, whenever there is an increase in the Capital and Financial Account, the balance in the Current Account will decrease. As we saw above, when interest rates rise in the United States, there will be a financial capital inflow. That financial capital inflow increases the balance on the Capital and Financial Account since foreign investors have purchased US assets. The financial capital inflow also causes the exchange rate for the US dollar to increase. The higher exchange rate means imports will be cheaper for US consumers, and US exports will be more expensive for foreign consumers. This change in the relative costs of imports and exports will decrease net exports, which decreases the balance on the Current Account.

If US interest rates decrease, on the other hand, there will be a financial capital outflow which decreases the balance on the Capital and Financial account. The financial capital outflow also causes the exchange rate for the dollar to decrease. The lower exchange rate means imports will be more expensive for US consumers and US exports will be cheaper for foreign consumers. This change in the relative costs of imports and exports will increase net exports, which increases the balance on the Current Account.