Monetary Policy Tools

Updated 6/13/2024 Jacob Reed

1. What is monetary policy? Monetary policy is how a country’s central bank works to achieve the economic goals of price stability and full employment. Central banks use monetary policy tools to change interest rates.

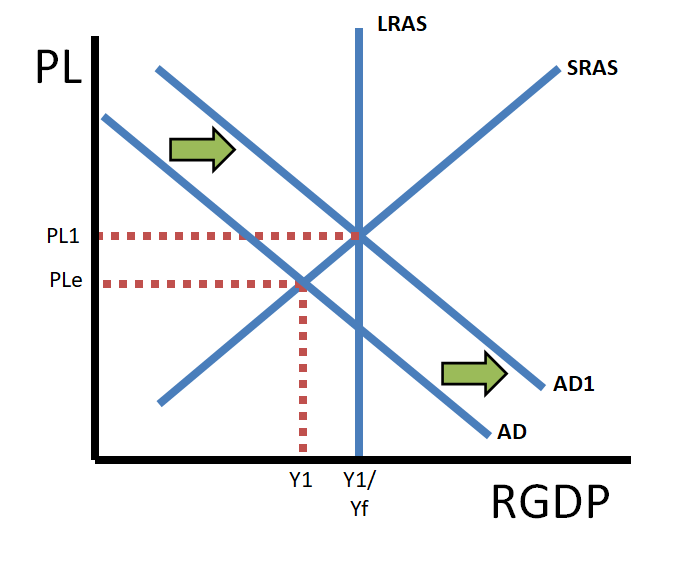

Those changes in interest rates change the quantity of investment (and other interest rate sensitive spending), which shifts the aggregate demand curve in the AS/AD model. That AD shift can change the price level to achieve price stability and change real output to achieve full employment.

2. What is Ample vs Scarce (limited) reserves?

Until recently the world’s economies operated in a system of scarce or limited reserves. That means banks loaned out nearly all of their excess reserves. With limited reserves in the banking system, small changes to the amount of bank reserves dramatically change the money supply and with that, the nominal interest rate in the money market. Central banks operating in a scarce reserves system use open market operations, the discount rate, and the reserve requirement to change the bank reserves and the nominal interest rate.

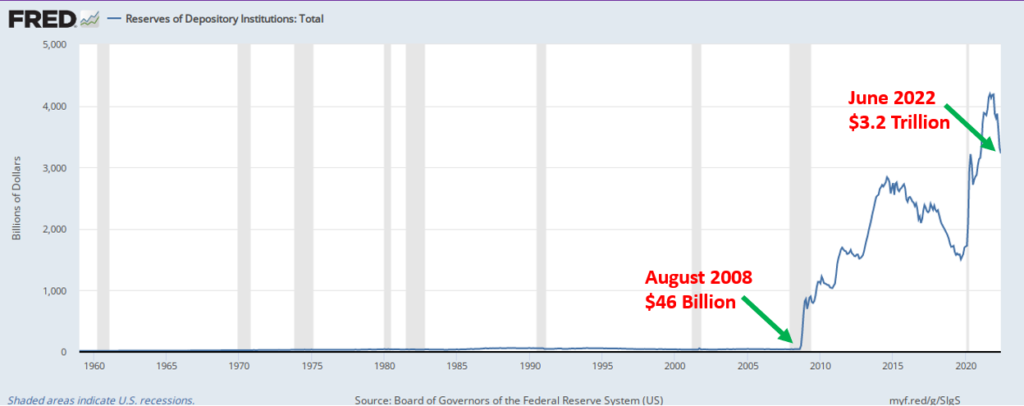

During the recession of 2008, the amount of reserves within the US banking system dramatically increased. Banks stopped loaning out nearly all of their excess reserves and old monetary policy tools became less effective at impacting the nominal interest rate. As a result, the Federal Reserve (and other central banks with an ample reserves system) must use new tools to change the nominal interest rate. The primary monetary policy tool is now Interest on Reserves.

In both systems, changes in the interest rate are used to achieve the goals of full employment and stable prices. Central banks work to lower interest rates to fight unemployment (to close a recessionary gap) and raise interest rates to fight inflation (to close an inflationary gap).

3. How does Monetary Policy work in a scarce reserves system?

In a scarce reserves system, 3 tools are used to shift the money supply and change the nominal interest rate in the money market. Each of those tools is described below:

Open market operations (the preferred tool of central banks with a scarce reserves system) include just 2 things: buying and selling government bonds (securities). When central banks buy bonds, the bond sellers deposit the proceeds in checking accounts. That increases excess reserves in the bank, allowing them to make more loans. More loans increases the money supply and decreases the nominal interest rates. When the central bank sells bonds the public buyers pay with money from their checking accounts. The money supply decreases and the nominal interest rate rises.

Note: You could see questions on your exams asking about open market policies or open market actions. These questions are about buying or selling bonds. These questions are not asking about discount rates or reserve requirements.

The reserve requirement (or required reserve ratio) is the percentage of demand deposits (or checkable deposits) which cannot be loaned out. If the reserve requirement is 10% and a customer makes a $1000 deposit, the bank may loan out $900 of excess reserves while keeping $100 of required reserves on hand. Decreasing the reserve requirement increases the loans banks can make. New loans increase the money supply and decrease the nominal interest rate in the money market. Increasing the reserve requirement decreases the money supply and increases the nominal interest rate.

The discount rate is the interest rate banks are charged when they borrow money from the central bank. If banks do not have enough money to cover the required reserves, they may borrow money from the central bank and pay the discount rate for the short-term (overnight) loan. Increasing the discount rate makes it more expensive for banks when they don’t have enough to cover their required reserves. That causes banks to loan less money, which decreases the money supply. Decreasing the discount rate makes it less expensive for banks when they don’t have enough funds to meet their required reserves. That causes banks to loan more, which increases the money supply.

All 3 of the above tools are used to target the interest rate banks charge each other for overnight loans. That interbank rate impacts all other interest rates in the economy. This rate is called the policy rate and is known as the Federal Funds Rate in the United States (but the US Federal Reserve uses the ample reserves framework).

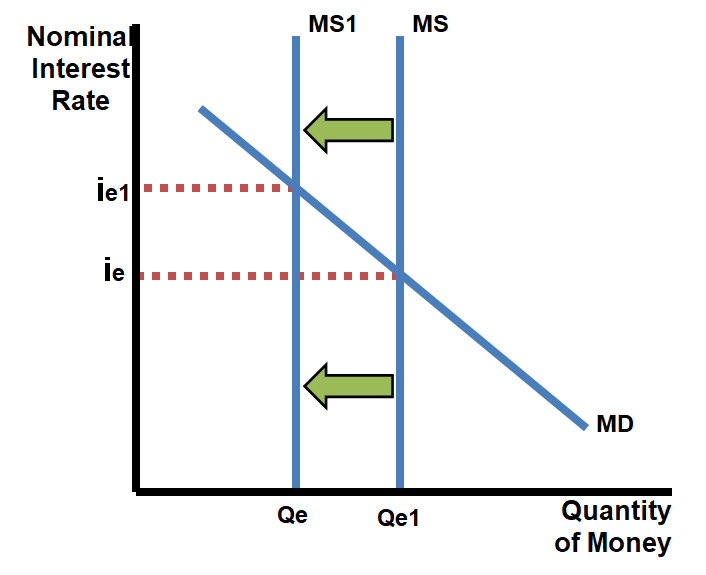

Contractionary Monetary policy is used to fight inflation. In a scarce reserves system a central bank can sell bonds on the open market, increase the discount rate, and/or increase the reserve requirement. Any of those actions will decrease the money supply and increase the nominal interest rate.

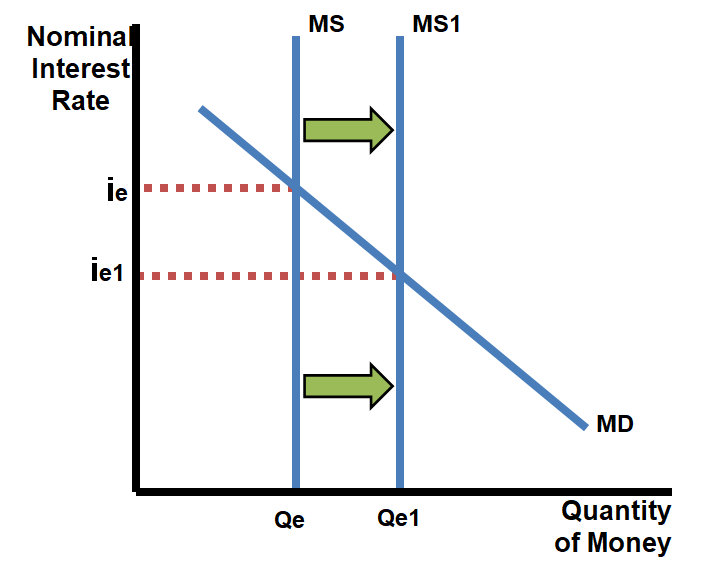

Expansionary Monetary Policy is used to fight unemployment. In a scarce reserves system and central bank can buy bonds on the open market, decrease the discount rate, and/or decrease the reserve requirement. Any of those actions will increase the money supply and decrease the nominal interest rate.

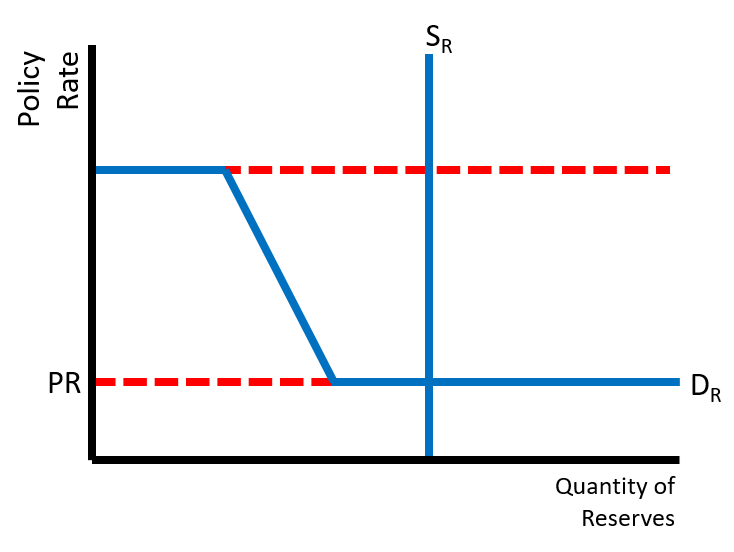

4.What is the reserves market graph?

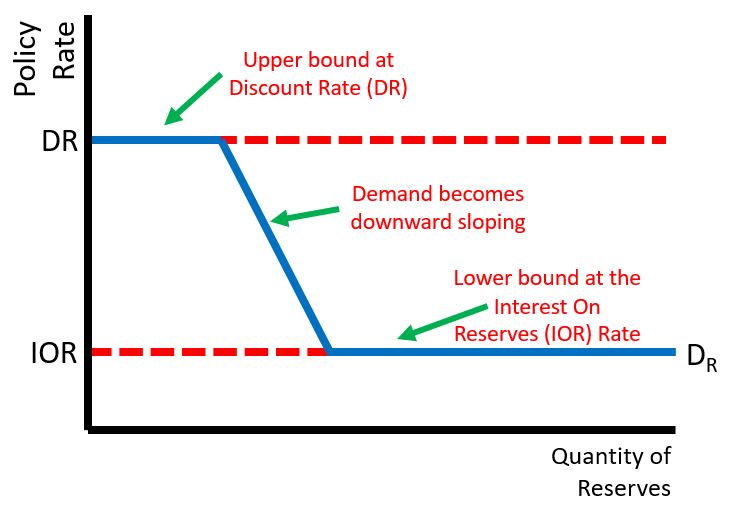

The reserves market is the model used by central banks with an ample reserves system (as opposed to the money market above used in the scarce reserves system). It shows how changes in Interest On Reserves can be used to target specific policy rates (again, the Federal Funds rate is the name of the US policy rate in the US).

The Demand for Reserves is a downward sloping curve with a flat upper bound and flat lower bound. The upper bound is the horizontal section on the top of the demand for reserves. That upper bound is at the discount rate. It is horizontal at the discount rate because banks will not demand (borrow) reserves at any interest rate higher than the discount rate. An increase in the discount rate lifts the upper bound, and a decrease in the discount rate lowers the upper bound.

There is a middle downward sloping section of the demand for reserves. There we see the inverse relationship between the policy rate and the quantity of reserves demanded. When the supply of reserves intersects the downwards loping section of the demand, the economy has a scarce reserves system.

The lower bound of the demand for reserves is the horizontal section at the bottom of the curve. That lower bound is at the Interest on Reserves Rate. When there are ample reserves, the interest on reserves acts as a floor. At high quantities of reserves, the policy rate moves towards the interest on reserves rate through a process called arbitrage (We’ve been told arbitrage is not on the AP Macro exam), that flattens and lifts the lower section of the demand for reserves, creating the lower bound. Increasing the Interest on Reserves.

The Supply of Reserves is the controlled by the actions and policies of the central bank. The supply of reserves is not responsive to the policy rate, so it is vertical at the equilibrium quantity of reserves. The central bank uses open market operations to shift the supply of reserves. Buying bonds, increases the supply and that action is used to keep the reserves market in ample reserves (where the supply intersects the demand on the lower bound). Selling bonds will shift the supply to the left.

The Policy Rate (PR) is found at the intersection of the supply and demand. When the supply intersects the demand at the lower bound (when there are ample reserves), small changes in the supply do not change the policy rate. As a result, open market operations do not change the policy rate in ample reserves. The policy rate is targeted by changing the interest on reserves rate to increase or decrease the lower bound.

5. How does Monetary Policy work in an ample reserves system?

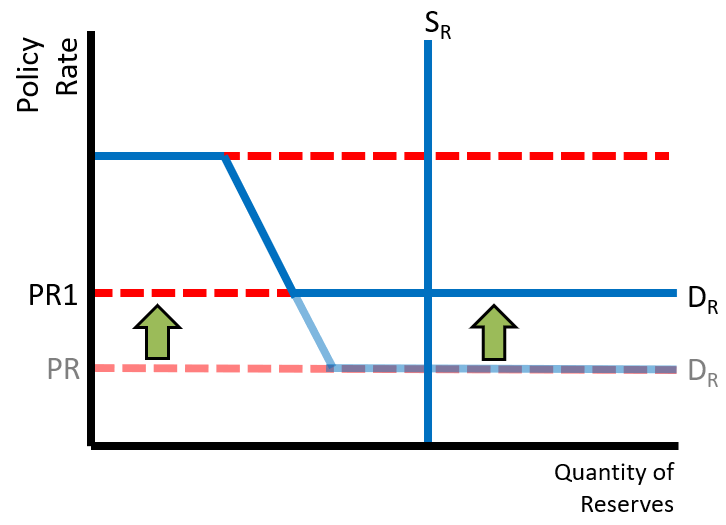

In an ample reserves system, central banks use the reserves market to influence nominal rates. The targeted rate for interbank lending is the policy rate (called the Federal Funds Rate in the United States).

Interest on Reserves is the primary tool used by central banks with an ample reserves system. Interest on reserves is the interest rate paid by the central bank to banks for their reserves. Since central banks can earn this rate on their reserves, the lower bound of the demand for reserves moves up with an increase in the interest on reserves rate and down with a decrease in the interest on reserves rate. Thse shifts of the lower bound of the demand for reserves changes the policy rate (Federal Funds Rate in the US).

Open Market Operations is used to maintain an ample reserves system. If banks make more loans, the supply of reserves decreases. Open market purchases shift the supply of reserves to the right, which keeps the supply on the lower bound of the demand.

Administered rates include both the Interest on Reserves rate and the discount rate. Increasing administered rates shifts the upper and lower bound of the demand curve upward. Decreasing administered rates shifts the upper and lower bound of the demand curve downward.

6. What is expansionary monetary policy?

It doesn’t matter if an economy has scarce or ample reserves, expansionary monetary policy decreases interest rates. Lower interest rates increase gross investment. That shifts aggregate demand to the right. Expansionary monetary policy can be used to fight unemployment. It results in greater real output (real GDP) and that means more employment and less unemployment. Expansionary policy also increases the price level.

Scarce Reserves Expansionary Policy (money market):

- Buy Bonds

- Decrease Discount Rate

- Decrease Reserve Requirement

Ample Reserves Expansionary Policy (reserves market):

- Decrease interest on Reserves or Decrease Administered Rates

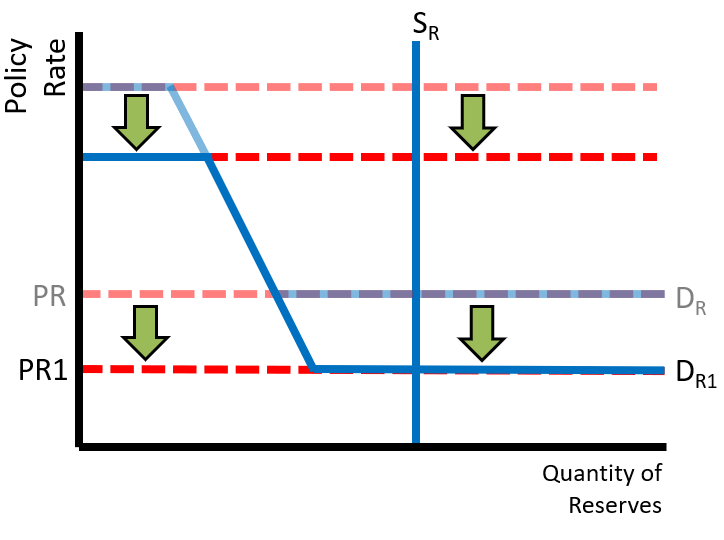

7. What is contractionary monetary policy?

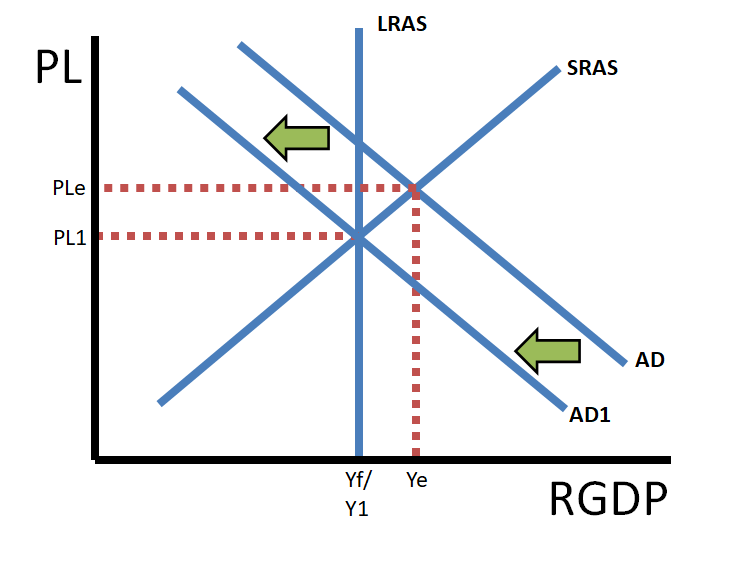

Contractionary monetary policy, on the other hand, increases interest rates. Higher interest rates decrease gross investment. That shifts aggregate demand to the left. Contractionary monetary policy can be used to fight inflation. It results in a lower price level which eases inflationary pressures. Contractionary policy also decreases real output and increases unemployment.

Scarce Reserves Contractionary Policy (money market):

- Sell Bonds

- Increase Discount Rate

- Increase Reserve Requirement

Ample Reserves Expansionary Policy (reserves market):

- Increase interest on Reserves or Increase Administered Rates

8. How does monetary policy impact the growth rate?

Since the interest rate directly impacts the quantity of investment and gross investment includes purchases of physical capital, interest rates can impact the growth rate of the economy. Higher interest rates tend to decrease investment and with it the growth rate. Lower interest rates tend to increase investment and the growth rate.

9. How does expansionary monetary policy impact the long run?

As mentioned above, expansionary monetary policy shifts the aggregate demand (AD) right; causing the price level and real output to increase in the short run. In the long run (as you learned in the section about the AS/AD model), wages and other input prices adjust to the price level. Since the rightward shift of the AD curve caused an increase in the price level, wages and other input prices will eventually increase to that level. When that happens, the higher input costs cause the short run aggregate supply (SRAS) to shift left. The long run result is only an increase in price levels with no increase in real output.

Up Next:

Review Games: Money Multiplier, Fiscal Policy/Monetary Policy Sorting

Content Review Page: Money Market Graph

Other recommended resource: ACDC