How do price controls impact markets?

Updated 3/22/2024 Jacob Reed

Below is a review of how price controls prevent a market from reaching equilibrium and create deadweight loss. If you would like to get some practice with these concepts, head over to the microeconomics important points, prices, and quantities game or the microeconomics graph shading practice.

When a market is at equilibrium, it is allocatively efficient; there is no deadweight loss and economic surplus (consumer surplus + producer surplus) is maximized.

Sometimes the government may impose price controls on a product to help alleviate a social problem; like prevent price gouging with price ceilings or help farmers with price floors. But there will be a loss of market efficiency and deadweight loss will replace some economic surplus.

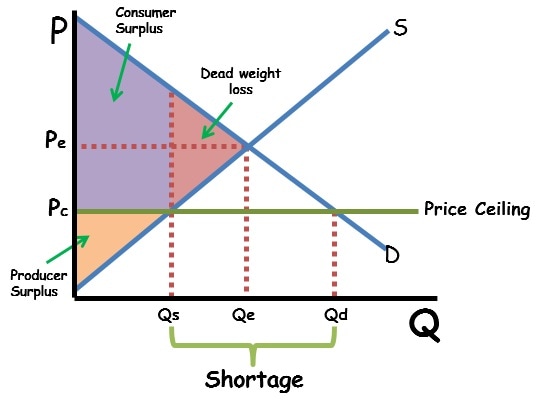

How does a price ceiling impact a competitive market?

A price ceiling is a maximum price set by the government that can be charged for a product. If the government imposes an effective price ceiling (one that is below the market equilibrium price), the market cannot reach equilibrium. At the artificially low price, the quantity supplied will be less than the quantity demanded. The difference between the two is a shortage. The Quantity supplied is all that gets sold with an effective price ceiling (the lower of the two quantities), because a firm cannot sell more than it is willing to make at this artificially low price. Since price cannot legally rise due to the price ceiling, the shortage will remain. This will create deadweight loss and the market will no longer be allocatively efficient.

*Note: if a price ceiling is placed above equilibrium, it is not effective (nor binding) so the market price will move toward equilibrium, and there will be no deadweight loss. An effective price ceiling must be below the equilibirum price.

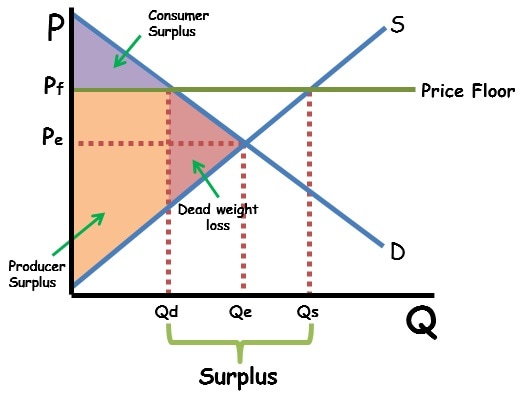

How does a price floor impact a competitive market?

A price floor is a minimum price set by the government that can be charged for a product. If the government imposes an effective price floor (one that is above the market equilibrium price) the market cannot reach equilibrium. At the artificially high price, the quantity demanded will be less than the quantity supplied. The difference between the two is a surplus. The quantity demanded is all that gets sold with an effective price floor (the lower of the two quantities), because a firm cannot sell more that consumers are willing to buy at this artificially high price. Since price cannot legally fall, the surplus will remain. This will create deadweight loss and the market will no longer be allocatively efficient.

*Note: if a price floor is placed below equilibrium, it is not effective (or binding) so the market price will move toward equilibrium, and there will be no deadweight loss. An effective price floor must be above the equilibirum price.

Multiple Choice Connections:

2012 Released AP Microeconomics Exam Questions: 4, 17

Up Next:

Review Game: Product Market Structures Review, Shading Practice, and Prices, Points, and Quantities

Content Review Page: Elasticity

Other recommended resources: ACDC Video, Economics Is Fun Video