What are the Effects of Government Intervention?

Updated 9/3/2019 Jacob Reed

Below you will learn how government interventions such as taxes, subsidies, price ceilings, and anti-trust legislation, impact different market structures. This content review covers the AP Microeconomics Course Exam Description (CED) 6.4.

How does government intervention impact perfectly competitive markets?

Taxes

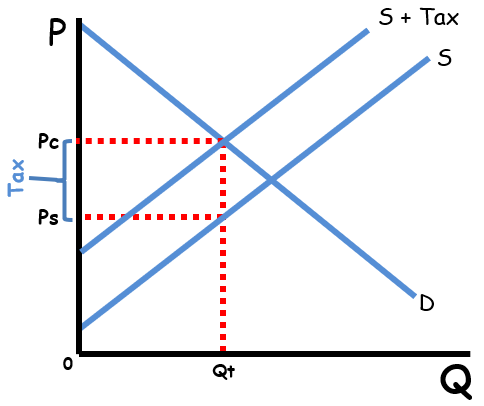

When the government imposes a tax on a good or service, the supply curve will shift to the left by the vertical distance of the tax. The new equilibrium quantity will decrease, the price consumers pay will increase, and the after-tax price sellers receive will decrease. If the product has no externalities, the tax will create deadweight loss. If the product produces a negative externality, a per-unit tax will reduce deadweight loss. If the product produces a positive externality, a per-unit tax will increase deadweight loss.

Subsidies

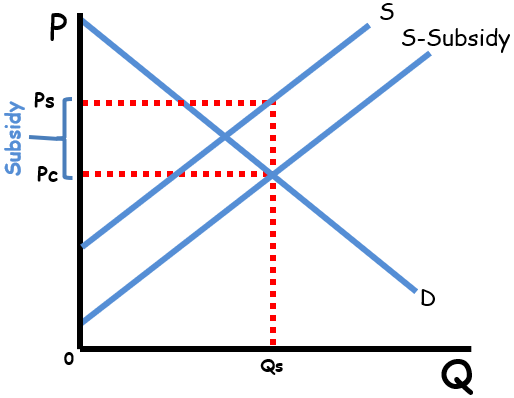

When the government grants a subsidy to the producers of a good or service, the supply curve will shift to the right by the vertical distance of the subsidy. The new equilibrium quantity will increase, the price consumers pay will decrease and the after-subsidy price sellers receive will increase. If the product has no externalities, the subsidy will create deadweight loss. If the product produces a positive externality, a per-unit subsidy will reduce deadweight loss. If the product produces a negative externality, a per-unit subsidy will increase deadweight loss.

Note: The overall impact on quantity, tax burden, and quantity will be impacted by the price elasticity of the supply and demand curves. See the excise taxes or externalities content review for more.

How does government intervention impact firms?

Cost curves of all firms

Lump sum subsidies are subsidies of a fixed amount to producers. Lump sum subsidies decrease the fixed costs for a firm and will shift the average total cost curve (ATC) downward. The firm’s profit will increase in the short run as a result of the lump sum subsidy.

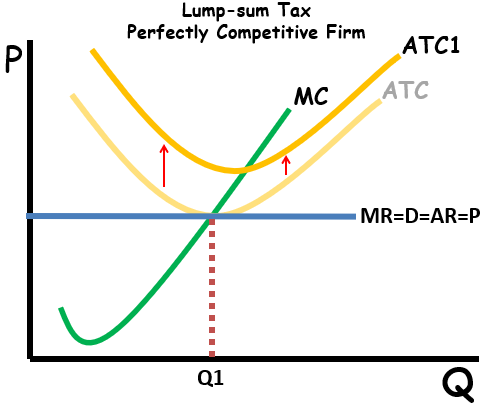

Lump sum taxes are fixed amount of tax on producers. Lump sum taxes increase a firm’s fixed costs and shift the ATC upward. Lump sum taxes and subsidies do not shift the marginal cost (MC) curve so they do not impact the firm’s output in the short run. The firm’s profit will decrease in the short run as a result of the lump sum tax.

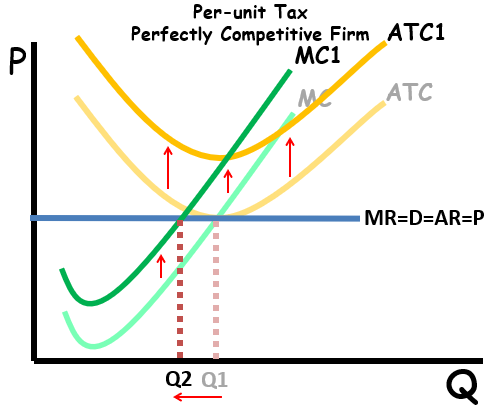

Per unit taxes and subsidies are of a given amount based on the quantity firms produce. They impact the variable costs of the firm. Per unit taxes and subsidies not only shift the ATC, but also the average variable cost (AVC) and MC. The MC shifts upward with a per unit tax and therefore decreases the quantity produced by the firm. The MC shifts downward with a per unit subsidy and therefore increases the quantity produced by the firm.

The impacts on quantity are true for both perfectly competitive and imperfectly competitive firms (such as monopoly and monopolistically competitive).

Price Ceilings on a Natural Monopoly

A natural monopoly is an industry which captures economies of scale at the allocatively efficient quantity resulting in much lower average costs when there is a large single provider. These businesses usually have extremely high start-up costs but have a very low marginal cost of production. Electricity providers are a prime example of natural monopolies. The most expensive part of providing homes in a city with electricity is putting up wires and cables all over town to carry the electricity. If electric service was not a monopoly and consumers had multiple choices regarding who to purchase electricity from, the costs of production would be dramatically higher (as multiple sets of cables and wires would need to be strung) and price would likely be higher as a result. So, the natural monopoly may actually benefit consumers.

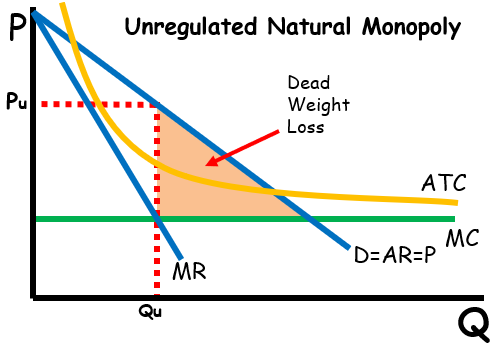

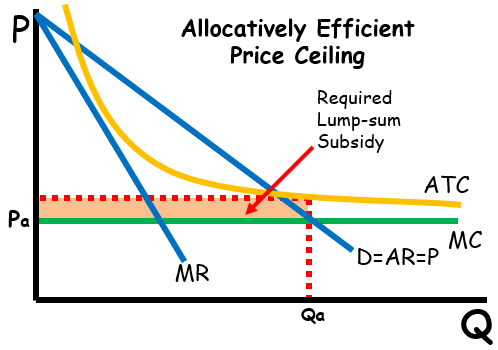

Governments will often regulate natural monopolies by imposing price ceilings which may be more efficient than the unregulated price. The socially optimal price is allocatively efficient and creates no deadweight loss where price equals marginal cost, but the firm may suffer economic losses at this price. If forced to earn economic losses, the firm will eventually exit the market so the government must provide the firm with a lump sum subsidy (equal to its loss) to eliminate deadweight loss.

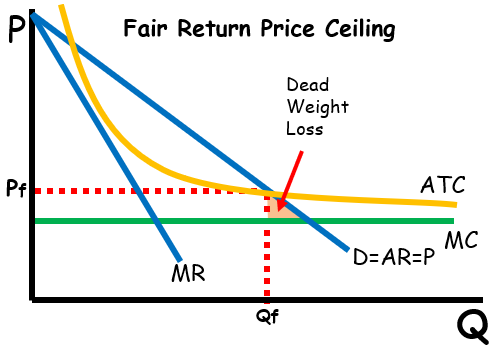

A fair return price is one which enforces a price ceiling where economic profits are zero (P=ATC). At the fair return price, there is less deadweight loss than an unregulated monopoly and the firm breaks even.

Anti-trust legislation

Oligopolies are prone to collusion or the formation of cartels which set production quantities low and prices high. When cartels are successful oligopolies function as monopolies. Governments often regulate oligopolies and attempt to prevent collusion and cartels while encouraging competition through anti-trust laws (like the Sherman Anti-trust Act and the Clayton Anti-trust Act). These anti-trust policies reduce monopoly power among firms. Fortunately, since there is an incentive to cheat, collusive agreements often break down even without anti-trust laws.